New research suggests that no- and low-alcohol drinks tend to be more expensive than standard alcoholic beverages. Colin Angus from the Sheffield Addictions Research Group examines some of the potential explanations for this ‘no/lo price premium’.

The last few years have seen a significant change in how no- and low-alcohol drinks are viewed in the UK, from largely being a curiosity a decade ago to being a standard piece of the wider landscape of alcoholic products. This change has happened alongside a big increase in the visibility and availability of no/lo alcohol products – something the UK government has stated they are keen to promote.

‘Manufacturing an alcohol-free beer is more complex and expensive’

The Sheffield Addictions Research Group (SARG) recently published the first in a series of monitoring reports, which attempted to describe and quantify the ‘no/lo’ market (drinks with less than 1.2% alcohol by volume). The report showed that, despite the cultural shift, no/lo drinks still represent only a small proportion of the overall alcoholic drinks market – just over 1% of all sales by volume.

One possible barrier to growth in no/low product sales has been price – a concern already raised in parliament. In theory, the fact that there is little or no alcohol duty payable on no/lo alcohol products should mean that an alcohol-free beer is substantially cheaper than a standard beer; the UK has some of the highest alcohol duty rates in Europe, with around 10% of the price of a typical 440ml can of beer or a third of the price of an average bottle of wine being made up of alcohol duty. However, manufacturing an alcohol-free beer is more complex and expensive than making an equivalent standard beer. Almost all no/lo beers and many other no/lo products are produced by making a standard alcoholic drink and then removing the alcohol – a process known as ‘dealcoholisation’. The costs to manufacturers of dealcoholisation are commercially sensitive, so we cannot know how it compares to the cost saving achieved through not having to pay alcohol duty on no/lo products.

‘No/lo drinks tend to be more expensive (with one exception)’

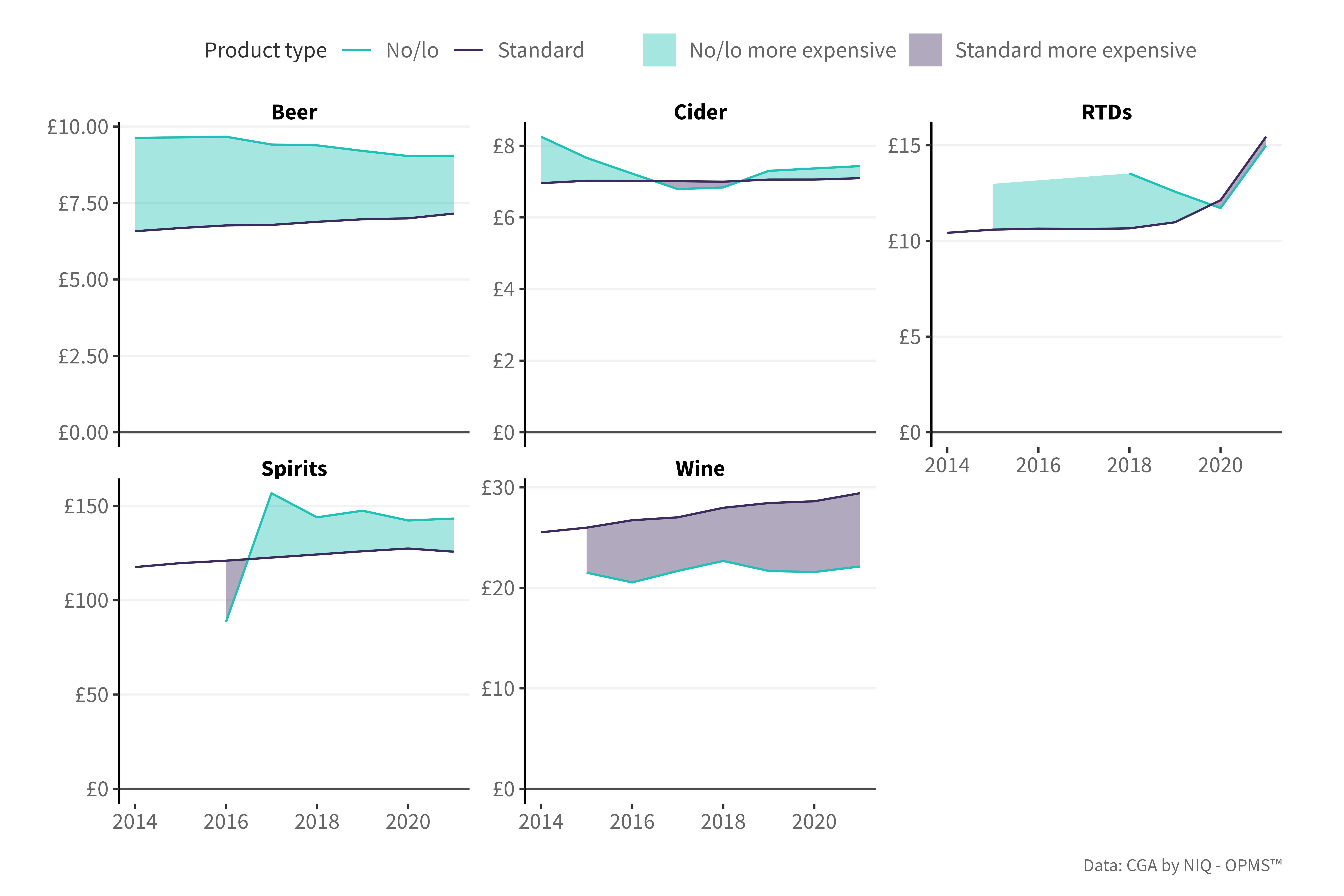

Helpfully, new data allows us to compare the prices of no/lo products in Great Britain with the prices of standard alcohol. Using data from two market research companies (CGA by NiQ and IRI), the team at SARG calculated the average prices per litre of standard and no/lo versions of beer, cider, pre-mixed drinks such as alcopops (known as ready-to-drinks or RTDs), spirits, and wine across a range of settings (pubs, bars, nightclubs, shops, and restaurants).

Beer was by far the most widely consumed no/lo product, accounting for over three-quarters of no/lo sales volume. In 2021, the average price paid for no/lo beer in pubs, bars clubs, and nightclubs was £9.04/litre compared to £7.15/litre for standard beer. This represents a large price gap, but it has reduced over time. The price premium for no/lo over standard beer fell from 46% in 2014 to 26% in 2021 as the prices of no/lo beer fell and the prices of standard beer rose.

A comparison of the average prices per litre of drinks shows that no- and low-alcohol versions of beer and spirits (and to some extent cider) tend to be more expensive than their standard alcoholic counterparts

The pattern was similar for spirits, with people paying more for no/lo spirits, on average, than standard spirits. Again, the gap has narrowed over time, after an initial ‘noisier’ period when the no/lo spirits market was extremely small.

There was relatively little difference between the prices paid for no/lo and standard ciders in pubs, bars, clubs, and nightclubs, with no/lo cider being 5% more expensive on average in 2021. Wine was notably different to the other categories, with prices paid for no/lo wine remaining consistently around 25% lower than standard wine.

For shop-bought alcohol, we only had data going back to 2020, but the patterns were generally similar, with prices paid for no/lo drinks being higher, except for wine. In 2021, people paid 8% more for a litre of no/lo beer than a litre of standard beer (£2.55 versus £2.35). For spirits, the gap in prices paid narrowed dramatically from 52% in 2020 to 9% in 2021, with partial 2022 data suggesting this price gap had disappeared entirely. Meanwhile the average price paid for no/lo wine was an average of 40% lower in shops in 2021 than the price paid for standard wine.

‘No/lo versions of products are more common among premium brands’

Dr Abi Stevely, a research fellow at SARG, conducted an exploratory analysis of the average prices people paid in shops for brands that offered standard alcohol and no/lo versions of products (e.g. a six-pack of 300ml cans of Heineken and the same multipack of Heineken 0.0). These results suggested that certain no/lo products may be cheaper than their standard alcoholic versions. For example, a six-pack of Heineken 0.0 cost £2.11 per litre compared to £2.73 per litre for the alcoholic equivalent. Similarly, a four-pack of 500ml Guinness 0.0 cost £1.44 per litre compared to £2.41 for standard Guinness. This could be seen as good news. In some cases, choosing a no/lo option may represent a cost saving as well as a potential health benefit. However, it may only be better-off groups who can benefit from this switch. No/lo versions of standard brands seem to be more common among ‘premium’ brands, which means that no/lo prices will naturally be biased upwards compared to standard alcohol products.

Another feature of the market that could inflate the average price of no/lo drinks is that consumers cannot avail themselves of the types of large pack sizes and bulk buy discounts that they can get with standard alcohol products. Many alcohol products, particularly beer, are widely available in large multipacks, which have a lower price per can than smaller packs (although this approach to pricing is banned in Scotland). No/lo products tend to be sold in smaller multipacks, meaning that average no/lo prices will also be biased upwards.

‘Higher prices could hinder attempts to drink less’

Overall, the findings suggest that for beer and spirits, and to some extent cider, there may be a price premium for no/lo products. The lack of lower-priced no/lo products may mean people would pay more for no/lo drinks than they would do for standard alcohol, which could hinder attempts to drink less. At a population level, this price disparity could also contribute to the persistence of health inequalities, as people with lower income levels are excluded from the potential health benefits of switching to no/lo drinks.

by Colin Angus

Colin Angus is a Senior Research Fellow in the Sheffield Alcohol Research Group within the Sheffield Centre for Health and Related Research (SCHARR). His work focuses on the design, development, and adaptation of complex health economic models and their use to appraise key policy questions in the field of alcohol research. In January 2024, Colin published “No- and low-alcohol drinks in Great Britain” with colleagues Professor John Holmes, Dr Inge Kersbergen, Dr Robert Pryce, Dr Abigail Stevely, and Dr Luke Wilson.

The opinions expressed in this post reflect the views of the author(s) and do not necessarily represent the opinions or official positions of the SSA.

The SSA does not endorse or guarantee the accuracy of the information in external sources or links and accepts no responsibility or liability for any consequences arising from the use of such information.